Stocks ticked higher Wednesday as traders awaited the release of new U.S. consumer inflation numbers and Treasury yields continued to retreat.

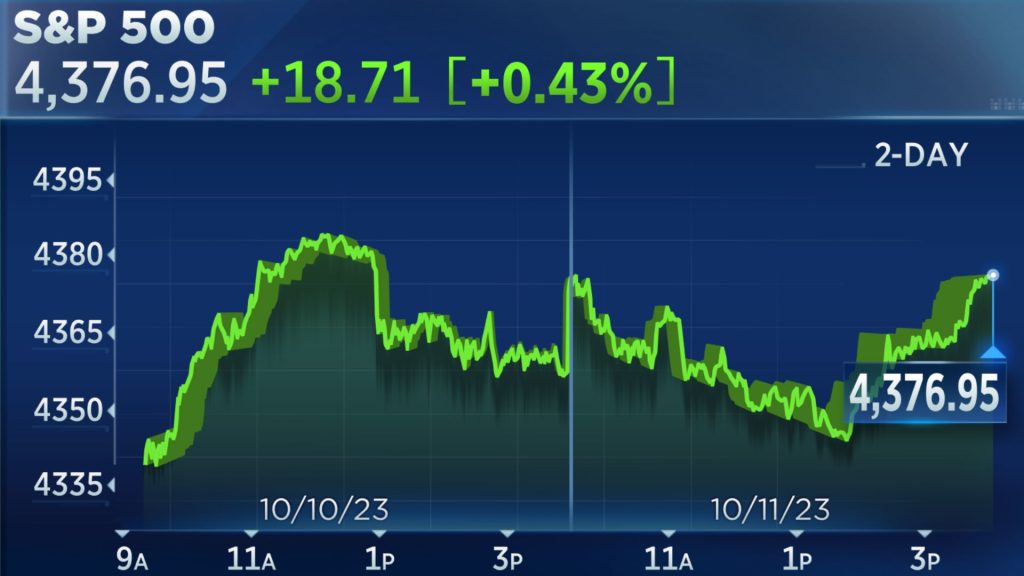

The Dow Jones Industrial Average was higher by 0.19%, or 65.57 points, to close at 33,804.87. The S&P 500 gained 0.43%, ending at 4,376.95. The tech-heavy Nasdaq Composite added 0.71%, landing at 13,659.68 and closing above its 50-day moving average, a first since Sept. 14.

It was also the fourth straight winning day for the three major averages.

The consumer price index report for September is slated for release Thursday. Economists surveyed by Dow Jones expect an increase of 0.3% from the previous month and 3.6% year over year. Investors will keep a close eye on the data as they search for clues on future Federal Reserve policy moves. The numbers will come a day after traders pored through hotter-than-expected wholesale inflation figures.

The producer price index rose 0.5% for September, coming out higher than the Dow Jones estimate for a 0.3% rise. The figure still represented a slowing from the 0.7% producer prices increase in the prior month.

The majority of Fed officials indicated at their September meeting that one more hike would be likely, minutes released Wednesday showed.

“A majority of participants judged that one more increase in the target federal funds rate at a future meeting would likely be appropriate, while some judged it likely that no further increases would be warranted,” the summary of the Sept. 19-20 policy meeting stated.

The yield on the 10-year Treasury note declined about 9 basis points on Wednesday, but hit a 16-year high earlier this month. Since the September Fed meeting, policymakers have indicated that higher yields could negate the need for future hikes.

“[The market is] really confused right now, but I think the overall trend of PPI, CPI and today’s Fed minutes are going to push the 10-year Treasury yield higher over the coming months,” said Derek Schug, head of portfolio management at Kestra Investment Management.

“There’s some concerns for stocks to be overly bullish but again, inflation is generally good and higher interest rates are generally not a bad thing for stocks over time,” he said.

To be sure, despite the economy being more resilient than expected, investors noted that inflation will continue to remain sticky.

Earlier Wednesday, Exxon Mobil agreed to buy shale driller Pioneer Natural Resources in an all-stock transaction worth $59.5 billion, the largest merger announced on Wall Street this year. Pioneer shares were up 1.4%, while Exxon was down by about 3.6%.

Sandal manufacturer Birkenstock slumped more than 12% after making its debut on Wednesday. Shares were priced at $46 each, but they tumbled to $40.20 by the end of the session.

Investors continue to assess the ongoing war unfolding between Israel and Hamas after the militant group launched an attack on Israeli civilians in what marked the deadliest offensive the country’s experienced in 50 years. President Joe Biden condemned the Hamas attacks as terrorism in remarks Tuesday and said that the United States stands with Israel.

Read the full article here